|

PRO PLAYBOOK

Leon Cooperman remains a cautious bull, and his favorite bet is a contrarian play.

Billionaire investor Leon Cooperman said the stock market is not susceptible to an imminent correction, and investors can still find plenty of bargains.

“The cyclical conditions are not ripe for a big decline,” he told CNBC. “I’m finding a lot of things to do in the market which is encouraging. … By and large most companies are not overvalued.”

The chairman and CEO of the Omega Family Office believes steep sell-offs are unlikely to occur coming out of a recession amid easy monetary policy and massive fiscal stimulus.

Cooperman revealed that his largest position is energy. He pointed out his top picks in the sector, including Canadian companies Tourmaline Oil and Paramount Resources as well as Devon Energy and Energy Transfer.

“My biggest position is a very contrarian view,” said Cooperman. “I came into the year with overweight energy and even more overweight now. I look at the natural gas situation. Storage levels are way below historical norms, and the price of natural gas has moved up quite dramatically.”

Elsewhere on Thursday, GameStop staged an impressive comeback from its post-earnings sell-off as retail investors bought the dip. But Wall Street analysts are still left frustrated by the company's lack of guidance.

Investors should sell their GameStop shares after the brick-and-mortar video game retailer shared little about the company’s turnaround plan, Loop Capital’s Anthony Chukumba said.

Baird analyst Colin Sebastian, who does not have a rating on the stock, said that the lack of clarity around the company’s revenue plans is a concern but that the rough plan may be coming into view with its new warehouse facilities.

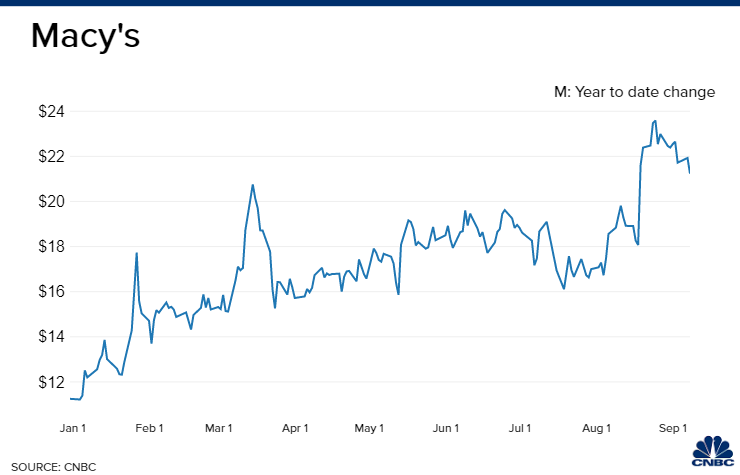

STOCKS WE ARE WATCHING Data as of Thursday, September 9, 2021 • 3:00 ET M

Cowen upgraded Macy's stock to outperform from market perform, saying the department store's push into digital and smart management has created upside for the stock. The firm raised its price target on Macy’s to $27 per share, more than 20% higher from its current level. BLDE

JPMorgan initiated coverage of Blade Air Mobility with an overweight rating, saying the company has the potential to become the Uber of the skies. JPMorgan set a price target of $16 per share for Blade, which is 82% above where the stock closed on Wednesday.

ASK HALFTIME

We’re bringing Ask Halftime to CNBC Pro. The "Halftime Report" traders will now take investment-related questions directly from subscribers and provide picks and insights just for you.

Submit your question directly to the Halftime team here.

TOP NEWS

|

|||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||